CNBC’s Steve Liesman: “Every day it seems the stock market goes up triple digits… is it now, or will it soon become a worry for the central bank that valuations are this high?”

Yellen’s response appeared very similar to Bernanke’s “contained” moment:

‘”The stock market has gone up a great deal this year,” and asset valuations are “elevated.”

“We see ratios in the high end of historical ranges,” but “Economists are not great at knowing what the right valuations are…we don’t have a terrific track record.”

“Low interest rates support higher valuations.”

”The risks in the global economy look more balanced than they have in recent years.”

”There is nothing flashing red there or possibly even orange,” on asset valuations…

So this is not even flashing orange?

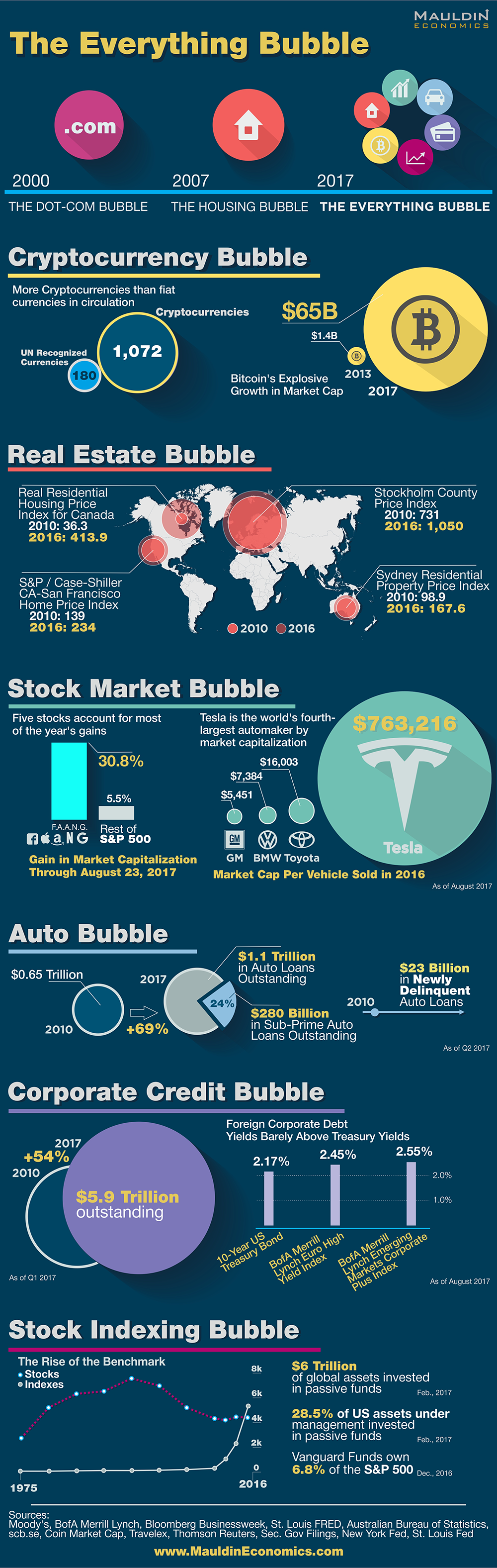

And this is not flashing red?

And none of this worries you?

Then Yellen turned to Bitcoin:

“Bitcoin, at this time, plays a very small role in the payments system.

It is not a stable store of value and it doesn’t constitute legal tender. It is a highly speculative asset.”

“The Fed doesn’t really play any regulatory role with respect with Bitcoin, other than ensuring banks are being prudent. “

Yellenb also said that creating a cryptocurrency “is not something the Federal Reserve is seriously considering at this stage…. There are limited benefits and a limited need for it.”

Finaly she summed up: “There’s less to lose sleep about now than in a long time”